Precious Metals Investment

Widely considered to be safe havens in times of market upheaval, Gold and Silver give traders access to a wealth of opportunities.

Diversify your investment – and your risk

As traditional safe haven assets, gold and silver can help diversify your investments and hedge against inflation.

Go long or short

When you trade gold and silver with us, you can profit from both rising and falling markets.

Take advantage of leverage

You only have to put up a fraction of the value of the trade to open a position. Leverage can magnify your profits and your losses.

Affordable Gold Plan

While many supporters believe that digital currencies could become part of daily life, the cryptocurrency market is currently dominated by speculative trading. Studies of blockchain activity show that exchange trades remain the most prevalent use for cryptocurrencies—and account for far more economic activity than ordinary trades and purchases. Cryptocurrency skeptics, including Warren Buffett, Bill Gates, and JPMorgan CEO Jamie Dimon have all warned of a potential crypto bubble.

With physical gold that you can own and have in your hand, generally the way the market works is that the larger the amount you invest in, the better the price. At Yielders Farm we encourage customers to set their monthly plan amount to one that they can comfortably afford.

| Plan Name | Daily Bonus | Duration | Min. Unit | Max. Unit | Unit Price ($) |

|---|---|---|---|---|---|

| VIAGGIO 10G GOLD BAR | 0.8% | 1 Months | 10 Units | 20 Units | $ 60.00 |

*Information for the above table is correct as of March 2nd, 2026.

Yielders Farm provides clients with a full-service precious metals trading capability and global access to the related financial markets through offices in London, Singapore, Shanghai, and Dubai. We specialize in serving bullion wholesalers and traders, refiners and smelters, government agencies, banks and financial institutions, jewellery manufacturers and other industrial users of precious metals.

We are reliable and competitive wholesale suppliers of gold, silver and platinum group metals in the form of London good-delivery bars, other bars, grains, sheets, doré, wafers and wire. We also buy scrap and semi-refined metal offering attractive payment terms.

Memberships

- London Bullion Market Association

- London Platinum and Palladium Market Association

- Clearing and Execution Members of the CME

- Singapore Bullion Market Association

- Trade Members of the Dubai Gold and Commodities Exchange

Whether you want to hedge your physical positions or take a directional view on the markets, we can offer you easy access to spot, forward, options or futures markets through our electronic trading platform or by speaking to one of our highly knowledgeable, multilingual team members.

In every instance our goal is the same: to help you grow your business, manage your risk and enhance profitability. We want you to have a great relationship with us – starting with a quick and efficient account opening process, competitive pricing and a flexible, customer-friendly service at all times.

Yielders Farm earns its clients' business and trust by offering expertise, extensive product coverage, global reach and access to markets that few other firms can.

Perhaps more importantly, our clients choose us because we put you first -- every time. We focus on building personal relationships and a deep understanding of your trading strategies and objectives. By striving to use our entrepreneurial, flexible and agile approach we provide real-time solutions to clients. The result is long-term relationships that add value beyond the individual deals or transactions.

Metals and Platform Services

LME & CME Metals and Platform Futures Services

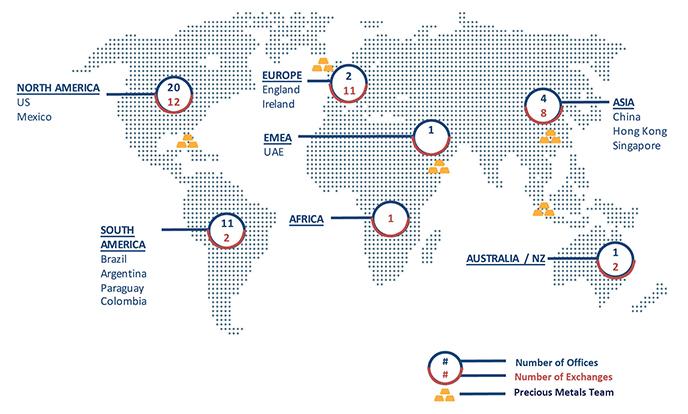

As a ring-dealing member of the London Metal Exchange (‘LME’) and a member of NYMEX/COMEX, Yielders Farm's metals teams specialize in aluminum, copper, zinc, lead, nickel, tin and a suite of ferrous products. Our metals futures, options and OTC capabilities are designed to meet the specific needs of our diverse customer base -- from CTAs and hedge funds to commercial metals producers, consumers and merchants, to FCMs and financial institutions. We offer 24-hour trade execution and clearing services through our operations in New York, London, Brazil, Sydney and Hong Kong, and via our strategic partners in Germany, Italy, Spain, Switzerland, Korea, India, Turkey, and Poland.

We have more than 100 LME professionals in offices around the world servicing clients in Europe, the Americas, the Middle East, Australia, and the Greater China Region. Our team has more than 35 years in the market; and our professional reputation, our expertise in metals, and our focus on client service ranks us as one of the top metals firms in the world.

Our worldwide metals teams enable our clients to execute and clear trades via voice or through electronic systems. We are members of or have access to 36 exchanges globally, with specialized IT staff in Hong Kong, London, and Chicago. We offer a number of platforms and have front-office staff to support not only metals futures, but also agricultural, energy, currency, and financial futures execution and clearing.

We offer both daily and monthly fundamental and technical analysis of the metals markets, as well as coverage of other commodities and macroeconomic trends.

The worldwide markets for precious metals have never been more competitive, volatile or complex. Yielders Farm's expert traders pair deep understanding of global market dynamics with local intelligence to help our clients protect margins, manage volatility and increase profits.

We offer a complete range of financial and physical trading services in gold, silver and platinum group metals. Clients can access markets through high-touch trading and advisory services and our convenient electronic trading platform. We provide Follow-the-Sun Order Services from Asia Open to New York Close.

We leverage Yielders Farm's global operations, logistics and IT infrastructure to provide seamless execution -- including financing, warehousing and deliveries for physical transactions across the globe.